Contents

function OptionsStraDemo

A Little Clean Work

tic;

format compact;

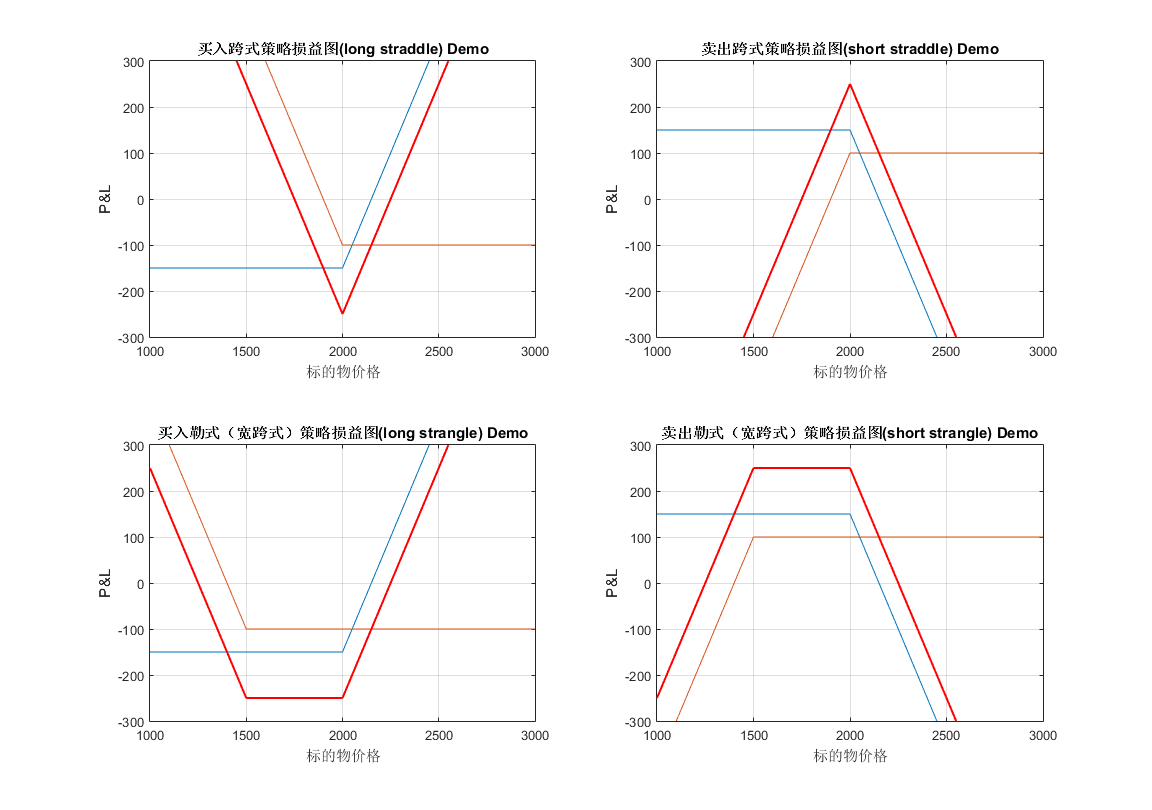

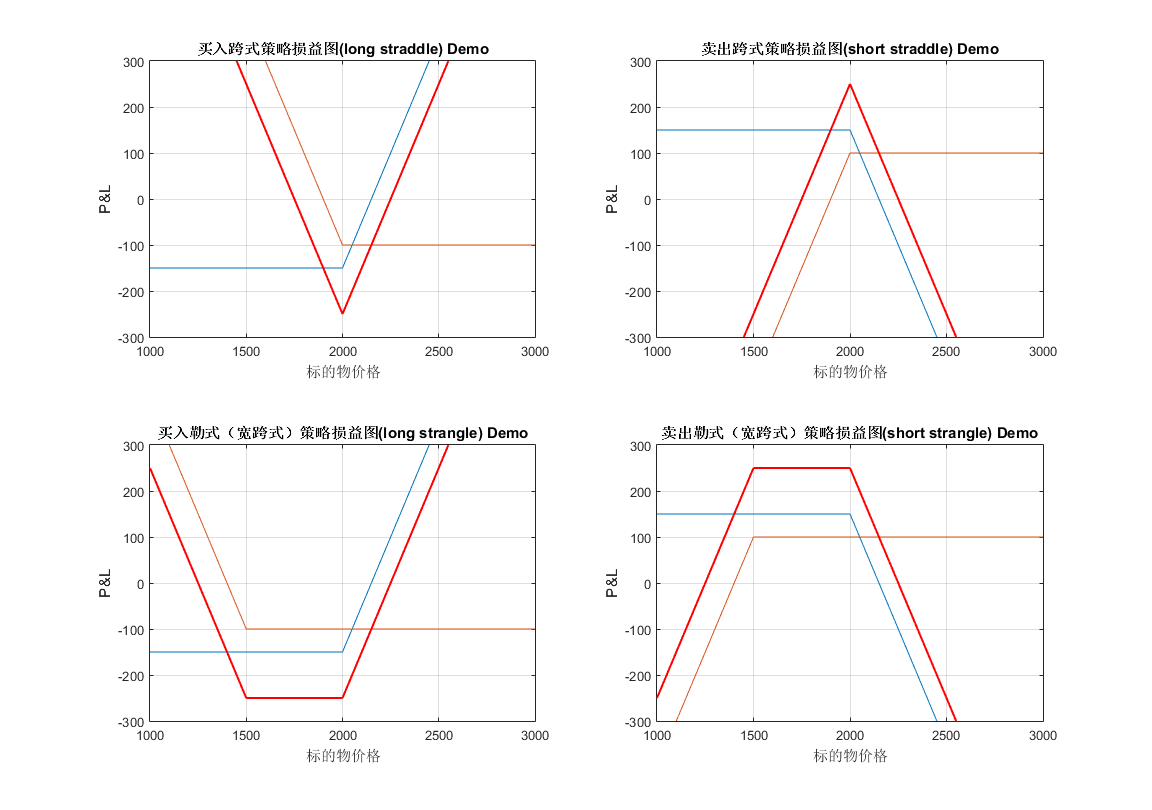

straddle && strangle

scrsz = get(0,'ScreenSize');

figure('Position',[scrsz(3)*1/4 scrsz(4)*1/6 scrsz(3)*4/5 scrsz(4)]*3/4);

subplot(221)

price = 1000:1:3000;

call_strike = 2000;

call_value = 150;

call_pl = (price<=call_strike).*-1*call_value + (price>call_strike).*(price-call_strike-call_value);

plot(price, call_pl);

hold on;

put_strike = 2000;

put_value = 100;

put_pl = (price>=put_strike).*-1*put_value + (price<put_strike).*(-1*price+put_strike-put_value);

plot(price, put_pl);

total_pl = call_pl + put_pl;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

ylim( [-300 300] );

grid on;

title('买入跨式策略损益图(long straddle) Demo', 'FontWeight', 'Bold');

subplot(222)

price = 1000:1:3000;

call_strike = 2000;

call_value = 150;

call_pl = (price<=call_strike).*-1*call_value + (price>call_strike).*(price-call_strike-call_value);

plot(price, -call_pl);

hold on;

put_strike = 2000;

put_value = 100;

put_pl = (price>=put_strike).*-1*put_value + (price<put_strike).*(-1*price+put_strike-put_value);

plot(price, -put_pl);

total_pl = call_pl + put_pl;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

ylim( [-300 300] );

grid on;

title('卖出跨式策略损益图(short straddle) Demo', 'FontWeight', 'Bold');

subplot(223)

price = 1000:1:3000;

call_strike = 2000;

call_value = 150;

call_pl = (price<=call_strike).*-1*call_value + (price>call_strike).*(price-call_strike-call_value);

plot(price, call_pl);

hold on;

put_strike = 1500;

put_value = 100;

put_pl = (price>=put_strike).*-1*put_value + (price<put_strike).*(-1*price+put_strike-put_value);

plot(price, put_pl);

total_pl = call_pl + put_pl;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

ylim( [-300 300] );

grid on;

title('买入勒式(宽跨式)策略损益图(long strangle) Demo', 'FontWeight', 'Bold');

subplot(224)

price = 1000:1:3000;

call_strike = 2000;

call_value = 150;

call_pl = (price<=call_strike).*-1*call_value + (price>call_strike).*(price-call_strike-call_value);

plot(price, -call_pl);

hold on;

put_strike = 1500;

put_value = 100;

put_pl = (price>=put_strike).*-1*put_value + (price<put_strike).*(-1*price+put_strike-put_value);

plot(price, -put_pl);

total_pl = call_pl + put_pl;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

ylim( [-300 300] );

grid on;

title('卖出勒式(宽跨式)策略损益图(short strangle) Demo', 'FontWeight', 'Bold');

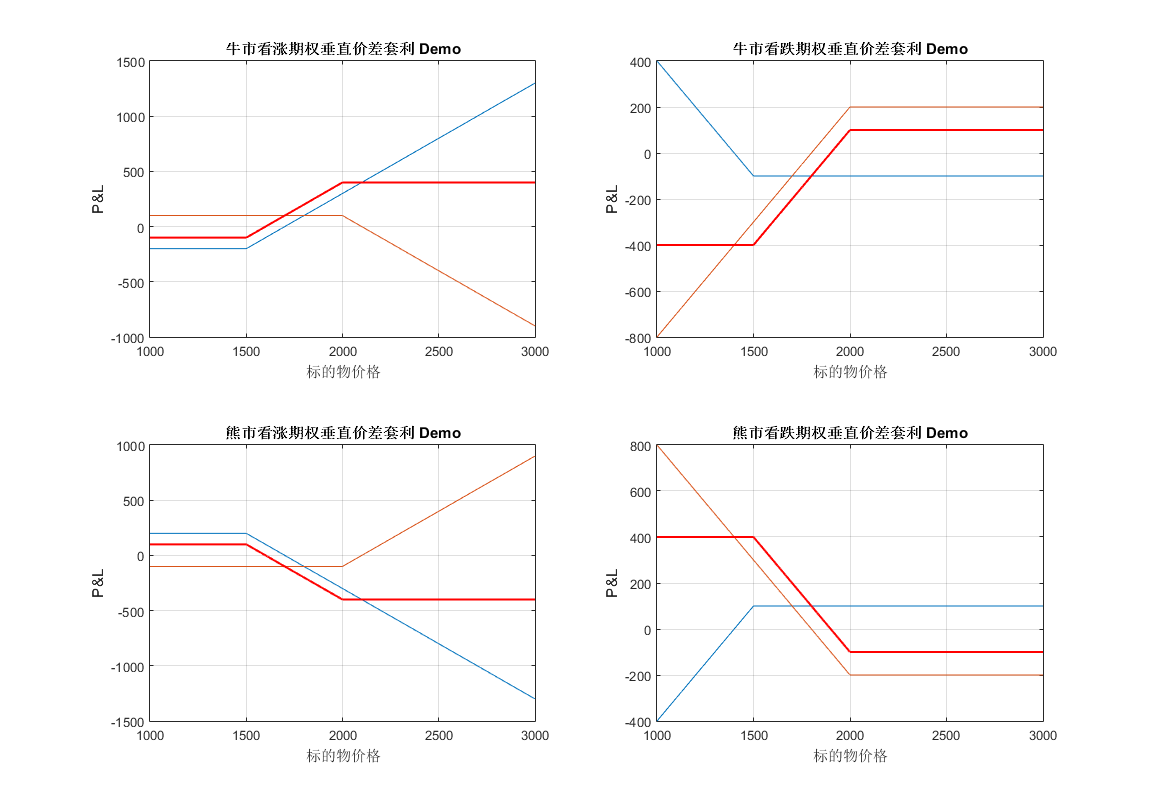

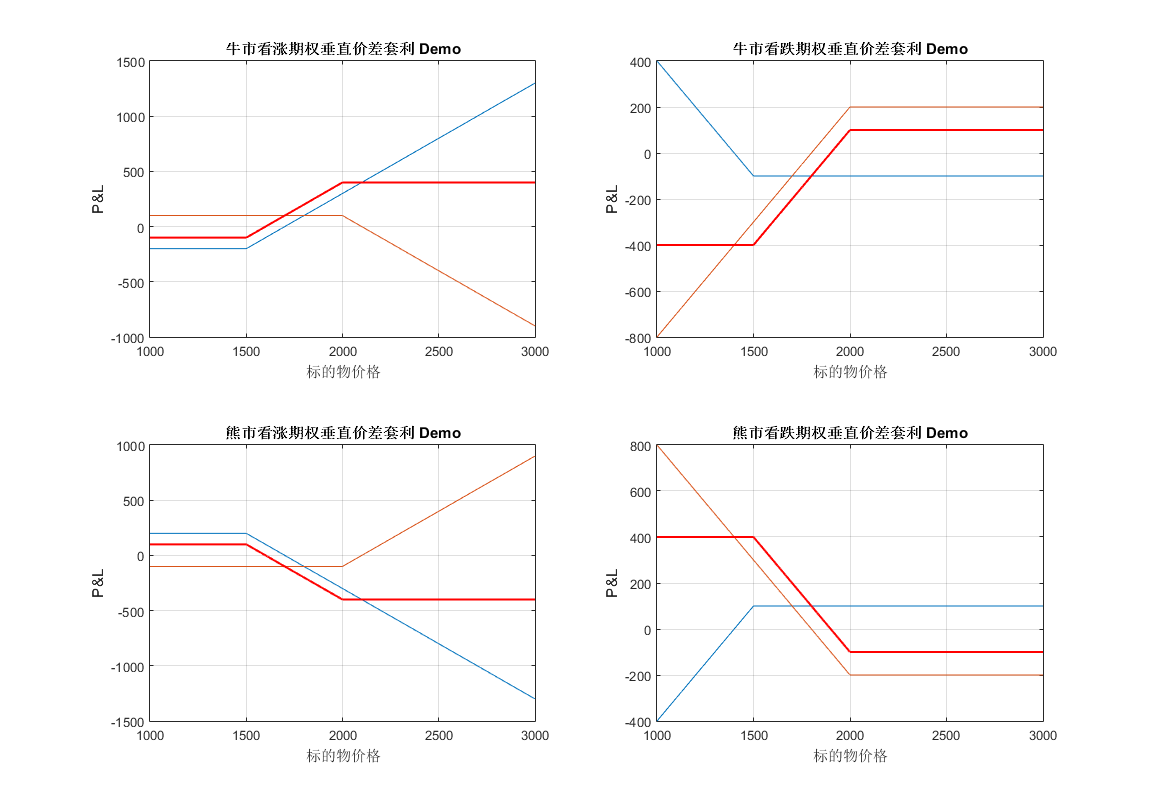

垂直价差套利

scrsz = get(0,'ScreenSize');

figure('Position',[scrsz(3)*1/4 scrsz(4)*1/6 scrsz(3)*4/5 scrsz(4)]*3/4);

subplot(221)

price = 1000:1:3000;

strike = 1500;

value = 200;

buy_call_pl = BuyCallPL( price, strike, value);

demopl = buy_call_pl;

plot(price, demopl);

hold on;

strike = 2000;

value = 100;

sell_call_pl = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl;

plot(price, demopl);

hold on;

total_pl = buy_call_pl + sell_call_pl;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('牛市看涨期权垂直价差套利 Demo', 'FontWeight', 'Bold');

subplot(222)

price = 1000:1:3000;

strike = 1500;

value = 100;

buy_put_pl = BuyPutPL( price, strike, value);

demopl = buy_put_pl;

plot(price, demopl);

hold on;

strike = 2000;

value = 200;

sell_put_pl = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl;

plot(price, demopl);

hold on;

total_pl = buy_put_pl + sell_put_pl;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('牛市看跌期权垂直价差套利 Demo', 'FontWeight', 'Bold');

subplot(223)

price = 1000:1:3000;

strike = 1500;

value = 200;

buy_call_pl = BuyCallPL( price, strike, value);

demopl = buy_call_pl;

plot(price, -demopl);

hold on;

strike = 2000;

value = 100;

sell_call_pl = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl;

plot(price, -demopl);

hold on;

total_pl = buy_call_pl + sell_call_pl;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('熊市看涨期权垂直价差套利 Demo', 'FontWeight', 'Bold');

subplot(224)

price = 1000:1:3000;

strike = 1500;

value = 100;

buy_put_pl = BuyPutPL( price, strike, value);

demopl = buy_put_pl;

plot(price, -demopl);

hold on;

strike = 2000;

value = 200;

sell_put_pl = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl;

plot(price, -demopl);

hold on;

total_pl = buy_put_pl + sell_put_pl;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('熊市看跌期权垂直价差套利 Demo', 'FontWeight', 'Bold');

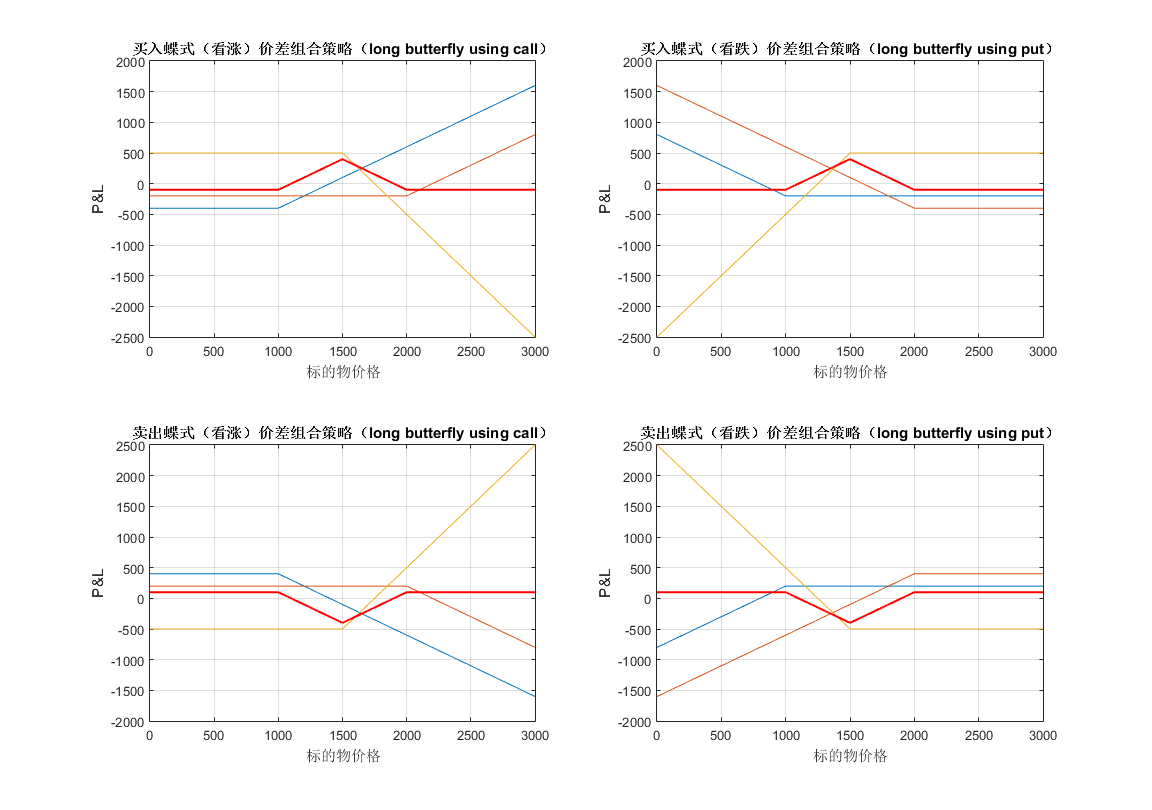

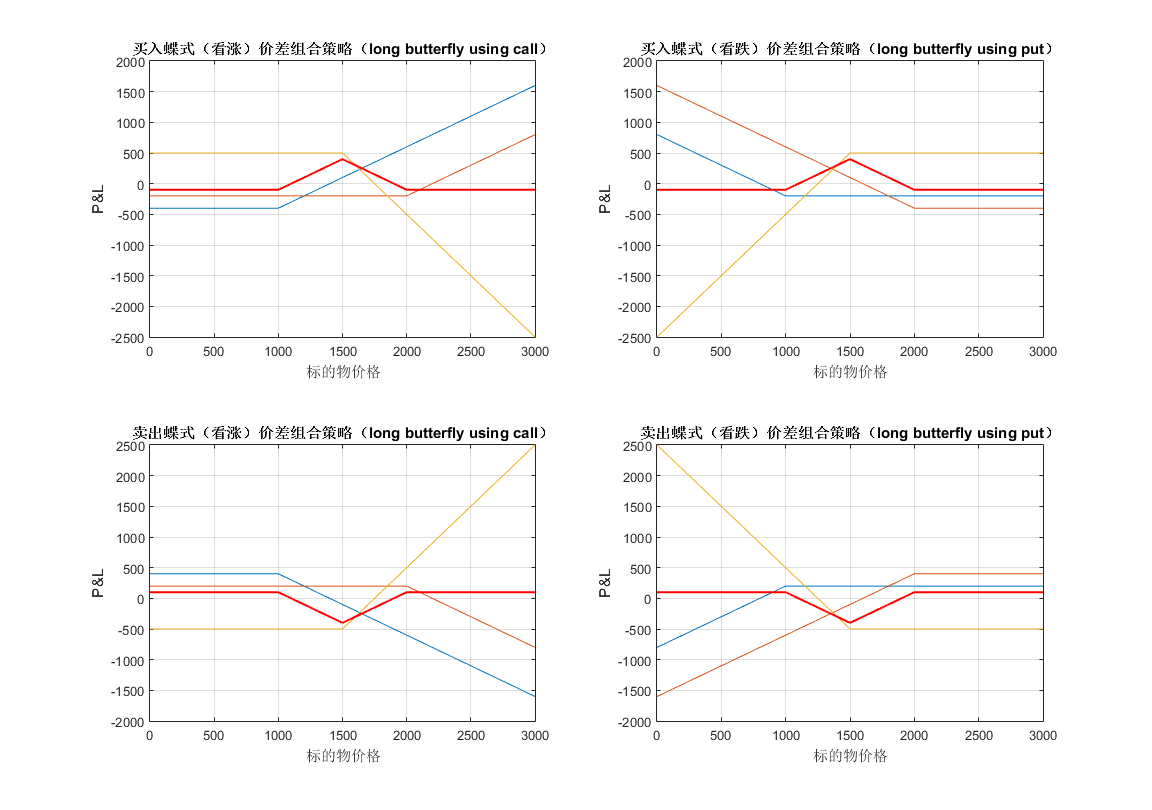

butterfly

scrsz = get(0,'ScreenSize');

figure('Position',[scrsz(3)*1/4 scrsz(4)*1/6 scrsz(3)*4/5 scrsz(4)]*3/4);

subplot(221)

price = 0:1:3000;

strike = 1000;

value = 400;

buy_call_pl1 = BuyCallPL( price, strike, value);

demopl = buy_call_pl1;

plot(price, demopl);

hold on;

strike = 2000;

value = 200;

buy_call_pl3 = BuyCallPL( price, strike, value);

demopl = buy_call_pl3;

plot(price, demopl);

hold on;

strike = 1500;

value = 250;

sell_call_pl = -2*BuyCallPL( price, strike, value);

demopl = sell_call_pl;

plot(price, demopl);

hold on;

total_pl = buy_call_pl1 + sell_call_pl +buy_call_pl3;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('买入蝶式(看涨)价差组合策略(long butterfly using call)', 'FontWeight', 'Bold');

subplot(222)

price = 0:1:3000;

strike = 1000;

value = 200;

buy_put_pl1 = BuyPutPL( price, strike, value);

demopl = buy_put_pl1;

plot(price, demopl);

hold on;

strike = 2000;

value = 400;

buy_put_pl3 = BuyPutPL( price, strike, value);

demopl = buy_put_pl3;

plot(price, demopl);

hold on;

strike = 1500;

value = 250;

sell_put_pl = -2*BuyPutPL( price, strike, value);

demopl = sell_put_pl;

plot(price, demopl);

hold on;

total_pl = buy_put_pl1 + sell_put_pl +buy_put_pl3;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('买入蝶式(看跌)价差组合策略(long butterfly using put)', 'FontWeight', 'Bold');

subplot(223)

price = 0:1:3000;

strike = 1000;

value = 400;

buy_call_pl1 = BuyCallPL( price, strike, value);

demopl = buy_call_pl1;

plot(price, -demopl);

hold on;

strike = 2000;

value = 200;

buy_call_pl3 = BuyCallPL( price, strike, value);

demopl = buy_call_pl3;

plot(price, -demopl);

hold on;

strike = 1500;

value = 250;

sell_call_pl = -2*BuyCallPL( price, strike, value);

demopl = sell_call_pl;

plot(price, -demopl);

hold on;

total_pl = buy_call_pl1 + sell_call_pl +buy_call_pl3;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('卖出蝶式(看涨)价差组合策略(long butterfly using call)', 'FontWeight', 'Bold');

subplot(224)

price = 0:1:3000;

strike = 1000;

value = 200;

buy_put_pl1 = BuyPutPL( price, strike, value);

demopl = buy_put_pl1;

plot(price, -demopl);

hold on;

strike = 2000;

value = 400;

buy_put_pl3 = BuyPutPL( price, strike, value);

demopl = buy_put_pl3;

plot(price, -demopl);

hold on;

strike = 1500;

value = 250;

sell_put_pl = -2*BuyPutPL( price, strike, value);

demopl = sell_put_pl;

plot(price, -demopl);

hold on;

total_pl = buy_put_pl1 + sell_put_pl +buy_put_pl3;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('卖出蝶式(看跌)价差组合策略(long butterfly using put)', 'FontWeight', 'Bold');

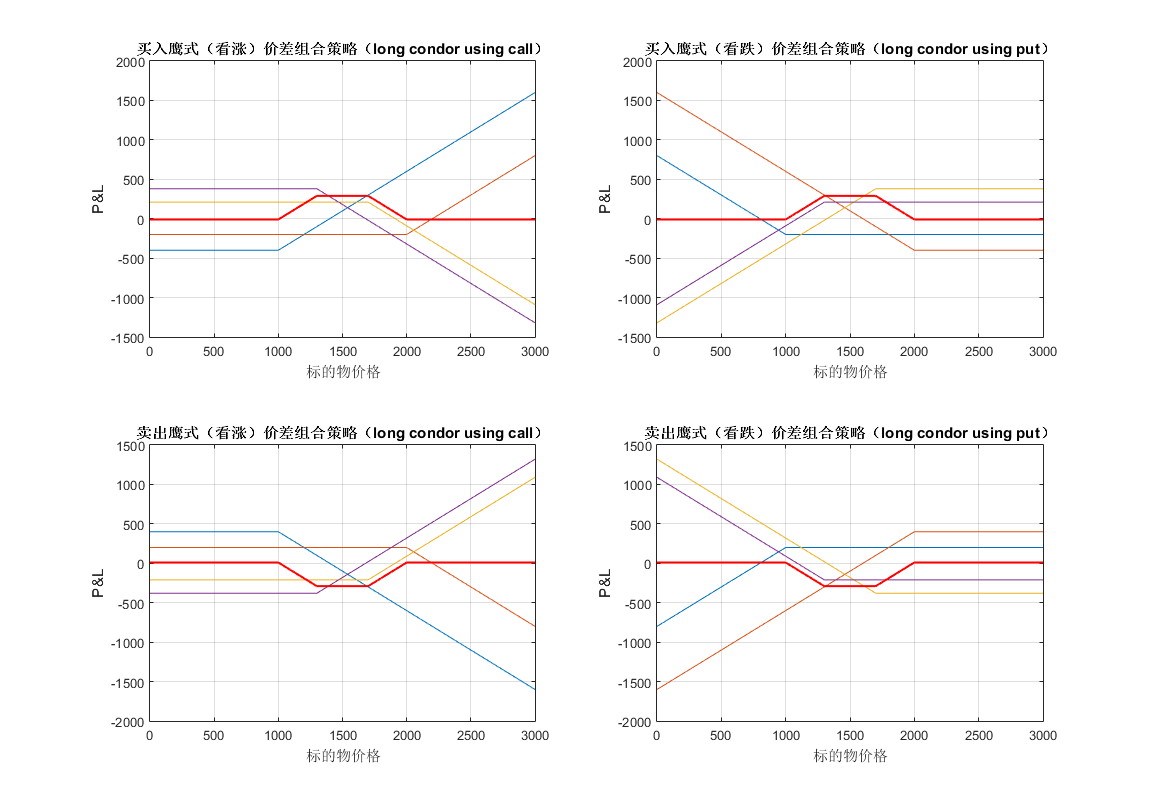

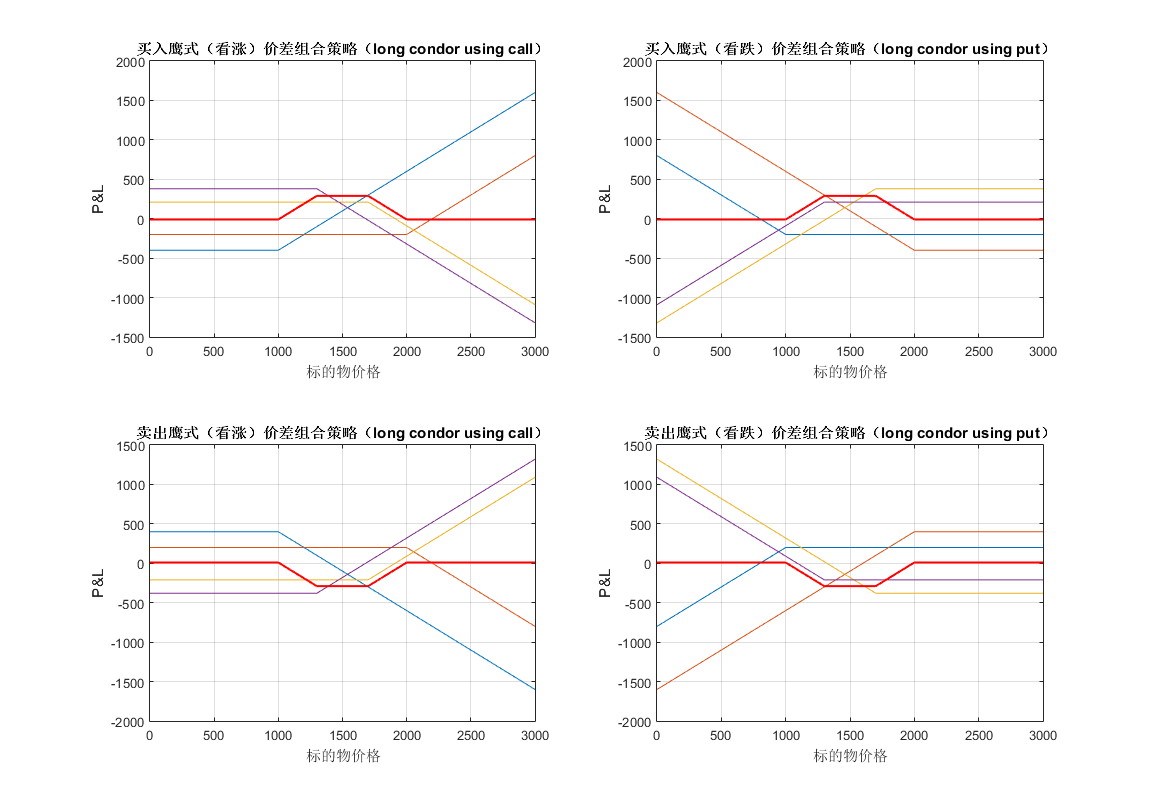

condor

scrsz = get(0,'ScreenSize');

figure('Position',[scrsz(3)*1/4 scrsz(4)*1/6 scrsz(3)*4/5 scrsz(4)]*3/4);

subplot(221)

price = 0:1:3000;

strike = 1000;

value = 400;

buy_call_pl1 = BuyCallPL( price, strike, value);

demopl = buy_call_pl1;

plot(price, demopl);

hold on;

strike = 2000;

value = 200;

buy_call_pl3 = BuyCallPL( price, strike, value);

demopl = buy_call_pl3;

plot(price, demopl);

hold on;

strike = 1700;

value = 210;

sell_call_pl1 = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl1;

plot(price, demopl);

hold on;

strike = 1300;

value = 380;

sell_call_pl2 = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl2;

plot(price, demopl);

hold on;

total_pl = buy_call_pl1 + sell_call_pl1 +sell_call_pl2 +buy_call_pl3;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('买入鹰式(看涨)价差组合策略(long condor using call)', 'FontWeight', 'Bold');

subplot(222)

price = 0:1:3000;

strike = 1000;

value = 200;

buy_put_pl1 = BuyPutPL( price, strike, value);

demopl = buy_put_pl1;

plot(price, demopl);

hold on;

strike = 2000;

value = 400;

buy_put_pl3 = BuyPutPL( price, strike, value);

demopl = buy_put_pl3;

plot(price, demopl);

hold on;

strike = 1700;

value = 380;

sell_put_pl1 = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl1;

plot(price, demopl);

hold on;

strike = 1300;

value = 210;

sell_put_pl2 = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl2;

plot(price, demopl);

hold on;

total_pl = buy_put_pl1 + sell_put_pl1 +sell_put_pl2 +buy_put_pl3;

plot(price, total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('买入鹰式(看跌)价差组合策略(long condor using put)', 'FontWeight', 'Bold');

subplot(223)

price = 0:1:3000;

strike = 1000;

value = 400;

buy_call_pl1 = BuyCallPL( price, strike, value);

demopl = buy_call_pl1;

plot(price, -demopl);

hold on;

strike = 2000;

value = 200;

buy_call_pl3 = BuyCallPL( price, strike, value);

demopl = buy_call_pl3;

plot(price, -demopl);

hold on;

strike = 1700;

value = 210;

sell_call_pl1 = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl1;

plot(price, -demopl);

hold on;

strike = 1300;

value = 380;

sell_call_pl2 = -1*BuyCallPL( price, strike, value);

demopl = sell_call_pl2;

plot(price, -demopl);

hold on;

total_pl = buy_call_pl1 + sell_call_pl1 +sell_call_pl2 +buy_call_pl3;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('卖出鹰式(看涨)价差组合策略(long condor using call)', 'FontWeight', 'Bold');

subplot(224)

price = 0:1:3000;

strike = 1000;

value = 200;

buy_put_pl1 = BuyPutPL( price, strike, value);

demopl = buy_put_pl1;

plot(price, -demopl);

hold on;

strike = 2000;

value = 400;

buy_put_pl3 = BuyPutPL( price, strike, value);

demopl = buy_put_pl3;

plot(price, -demopl);

hold on;

strike = 1700;

value = 380;

sell_put_pl1 = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl1;

plot(price, -demopl);

hold on;

strike = 1300;

value = 210;

sell_put_pl2 = -1*BuyPutPL( price, strike, value);

demopl = sell_put_pl2;

plot(price, -demopl);

hold on;

total_pl = buy_put_pl1 + sell_put_pl1 +sell_put_pl2 +buy_put_pl3;

plot(price, -total_pl, 'r', 'LineWidth', 1.5);

ylabel('P&L');

xlabel('标的物价格');

grid on;

title('卖出鹰式(看跌)价差组合策略(long condor using put)', 'FontWeight', 'Bold');

sub function-BuyCallPL

function pl = BuyCallPL( price, call_strike, call_value)

pl = ...

(price<=call_strike).*-1*call_value + (price>call_strike).*(price-call_strike-call_value);

end

sub function-BuyPutPL

function pl = BuyPutPL( price, put_strike, put_value)

pl = ...

(price>=put_strike).*-1*put_value + (price<put_strike).*(-1*price+put_strike-put_value);

end

Record Time

toc;

Elapsed time is 4.032251 seconds.

end